At any given moment, you peek at your sales-to-labor ratio or determine if sales are meeting historical averages. These financial snapshots give you the power to take action, in real-time with minimal effort. While long-term trend analysis is important, you should also log revenue reports on the daily and weekly. You can also use your revenue reports to show you how to set realistic sales targets and evaluate operations. If you do decide to manage your restaurant’s finances, still consider outsourcing payroll. That’s because there are liability issues and high penalty fees on the line for mistakes made in payroll.

Download our free inventory template

Doesn’t matter if your bookkeeper is in-house or outsourced, talk to this person outside of your restaurant. Restaurant owners and managers are so busy and they get used to jumping up to greet a customer, handle an issue or take a phone call. A lot of the understanding is the language that makes it so different than https://www.bookstime.com/ other accounting other industries. I had a call with a potential client restaurant owner last week and he got the feeling that I am familiar with and speak the so-called language of hospitality finance. Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

What is a restaurant chart of accounts?

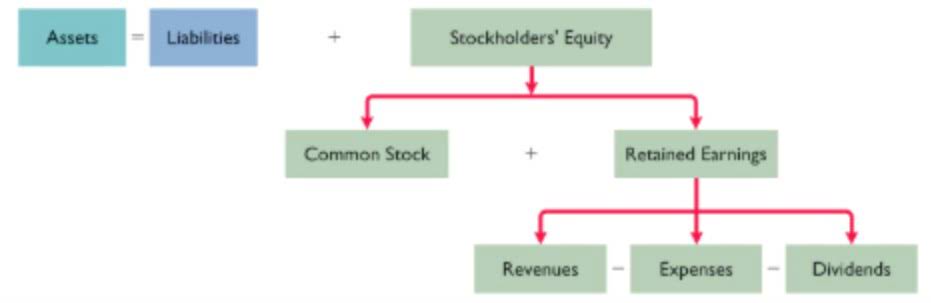

Finding a bookkeeper who understands the complexity of the food and beverage industry, both front-of-the-house operations and back-of-the-house management. With a focus on accurate record-keeping and financial analysis, Restaurant Bookkeeping helps clients streamline their restaurant bookkeeping accounting processes and make informed business decisions. A balance sheet shows the restaurant’s equity, liabilities, and assets for a specific period. This cash flow report checks the restaurant’s financial health and forecasts short-term and long-term cash flow.

Setting Up Your Books

A restaurant profit and loss statement, or P&L, keeps all restaurant accounting information organized in one concise document. Some restaurants struggle to pay sales tax, so it’s useful to have a separate account that can be used to deposit what’s collected. That way, it’s not as much of a shock when making lump-sum payments on a set schedule. Once you’re behind on your restaurant accounting, it is difficult to get caught up. Cost of goods sold (COGS) is the total cost of all the ingredients you use to make menu items, right down to the garnishes, condiments, and herbs.

What are the fundamental financial metrics for reviewing a restaurant’s economic performance?

- It records income as it enters your bank account and records expenses when they’re paid.

- Long hours, high overhead, wasted ingredients, and difficulty making profits are some of the barriers to restaurant owners’ success.

- The daily sales report is your quintessential end-of-day report that measures costs, sales, and future sales.

- By analyzing different revenue sources, you can determine which areas of your business are the most profitable—whether that’s food sales, alcohol sales, merchandise purchases, or catering.

- With this number in hand, you can start to think about ways to get more people into your restaurant (e.g., add another table or use smaller and more stools at the bar) in order to boost revenue.

- They are great for cash management, processing receipts, running sales reports, tracking inventory, methods of payment, and labor costs.

Overhead rates are the monthly fixed costs it takes to run your business. Total fixed costs are divided by total operating hours to calculate overhead rates. There are some financial analysis tools you’ll want to use when reviewing your financial reports. Financial statements should be reviewed and analyzed every month so if something is off track; you can catch it early before it gets out of hand.

Learn How We Can Impact Your Business Growth

Use accounting software

- A restaurant owner should constantly monitor cash flow or the money coming in and out.

- When you calculate break-even point in units, you’re learning how many pizzas, coffees, fixed price meals you’ll need to sell to achieve that same goal.

- But knowing the basics of restaurant accounting can pay dividends in helping you understand your accountant better and manage your money.

- Tracking this metric will help you reduce and stabilize your inventory costs.

- If you incorrectly file your payroll taxes or file them late, the penalties and interest you will be assessed can be quite large.

- It’s extremely important that your accounting software integrates with your POS system.

Automate Your Restaurant POS with QuickBooks Online

- You can also use your revenue reports to show you how to set realistic sales targets and evaluate operations.

- Multiple users can access Shoeboxed, so collaboration on bookkeeping tasks is a breeze.

- Many find QuickBooks for restaurants to be an effective recording system.

- With restaurant accounting software, you can create financial statements, like income statements, cash flow statements, and balance sheets.

News you care about. Tips you can use.