All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Investors should compare the fully diluted EPS of companies in the same industry to assess their financial health and performance. Non-recurring events and exceptional items can also impact the fully diluted EPS calculation. These assumptions and estimates may not always be accurate, which can impact the accuracy of the fully diluted EPS calculation. Below is a break down of subject weightings in the FMVA® financial analyst program.

Do you own a business?

The effect on the investor who held common shares prior to the dilution is the same as a secondary offering, as their percentage of ownership in the company decreases when the new shares are brought to market. While it primarily affects equity ownership positions, dilution also reduces the company’s earnings per share (EPS, or net income divided by the float), which often depresses stock prices in the market. For this reason, many public companies publish estimates of both non-diluted and diluted EPS, which is essentially a “what-if-scenario” for investors in the case new shares are issued. Diluted EPS assumes that potentially dilutive securities have already been converted to outstanding shares. Anti-dilution provisions act as a buffer to protect investors against their equity ownership positions becoming diluted or less valuable. This can happen when the percentage of an owner’s stake in a company decreases because of an increase in the total number of shares outstanding.

What EPS Tells Investors

A higher fully diluted EPS can lead to a higher P/E ratio, indicating that investors are willing to pay more for a company’s stock. If and when employees choose to exercise the options, then common shares may be significantly diluted. Key employees are often required to disclose in their contracts when and how much of their optionable holdings they expect to exercise. Assume a small business has 10 shareholders and that each shareholder owns one share, or 10%, of the company. If investors receive voting rights for company decisions based on share ownership, then each one would have 10% control.

- CFI is on a mission to enable anyone to be a great financial analyst and have a great career path.

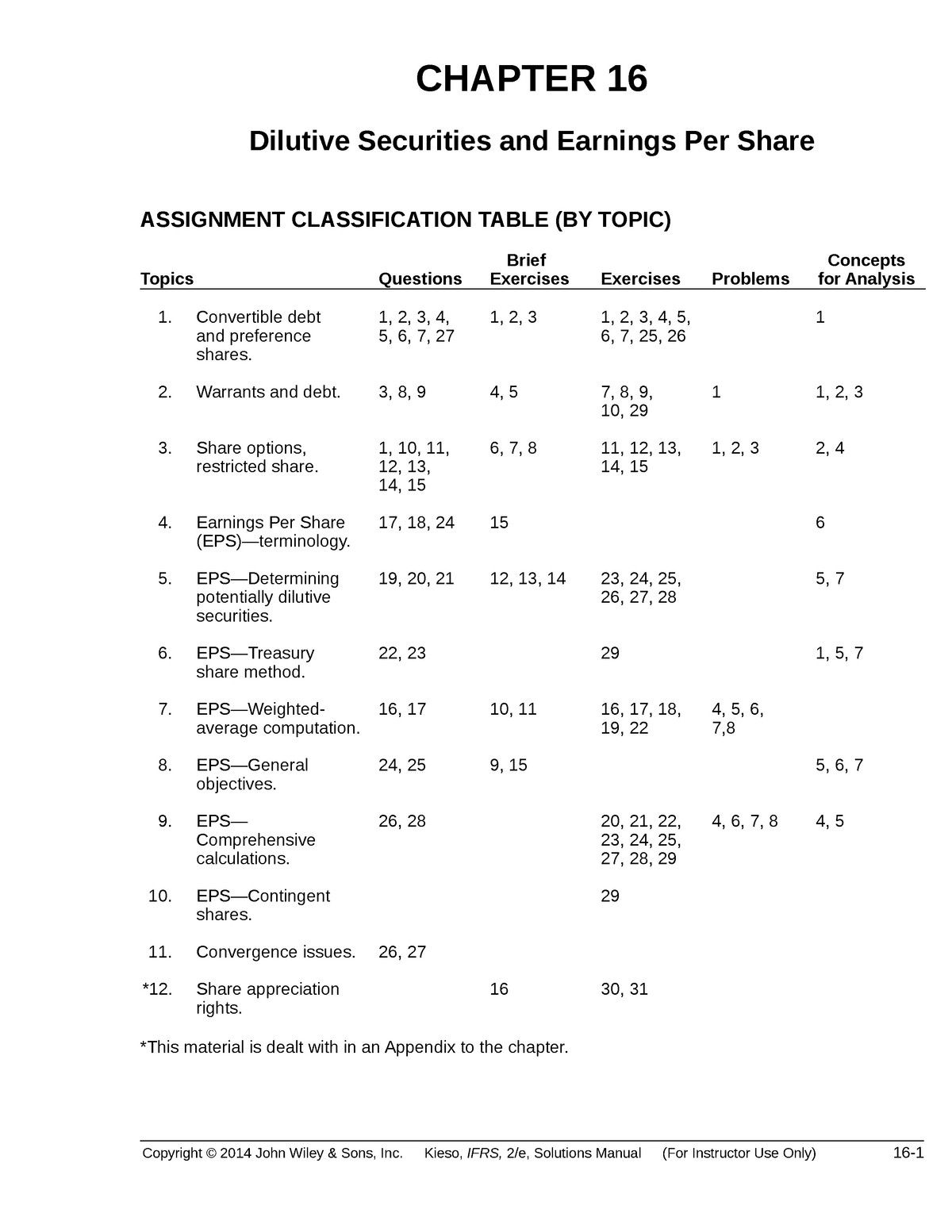

- Examples of dilutive securities include stock options, convertible preferred stocks, convertible bonds and warrants.

- This means that the investor can convert their preferred shares or convertible debt into common shares at the same price as the new investors.

- The if-converted method is used to calculate diluted EPS if a company has potentially dilutive preferred stock.

- Suppose the company then issues 10 new shares and a single investor buys them all.

Part 2: Your Current Nest Egg

After all, by adding more shareholders into the pool, their ownership of the company is being cut down. That may lead shareholders to believe their value in the company is decreasing. In certain cases, investors with a large chunk of stock can often take advantage of shareholders that own a smaller portion of the company. EPS is also used in merger analysis where public companies analyze if a sizable acquisition will be potentially accretive or dilutive to their earnings.

How Does a Diluted EPS Affect Shareholders?

This adjustment increases the number of shares the investor can convert their securities into, thereby preserving their ownership percentage and investment value. Dilution can be particularly vexing to preferred shareholders of venture capital deals, whose stock ownership may become diluted when later issues of the same stock hit the market at a cheaper price. Anti-dilution provisions can discourage this from happening by tweaking the conversion price between audit working papers convertible securities, such as corporate bonds or preferred shares, and common stocks. In this way, anti-dilution clauses can keep an investor’s original ownership percentage intact. Convertible preferred stocks are a type of security that can be converted into common stock at a later date. When convertible preferred stocks are converted into common stock, the number of outstanding shares increases, which can impact the fully diluted EPS calculation.

These employee stock options are often granted instead of cash or stock bonuses and act as incentives. When the option contracts are exercised, the options are converted to shares and the employee can then sell the shares in the market, thereby diluting the number of company shares outstanding. The employee stock option is the most common way to dilute shares via derivatives, but warrants, rights, and convertible debt and equity are sometimes dilutive as well.

So, you will still get your piece of the cake only that it will be a smaller proportion of the total than you had been expecting, which is often not desired.

Diluted EPS can provide a more accurate picture of a company’s financial condition than ordinary EPS. Since many companies have obligations that could result in additional shares being issued, it is best to express financial metrics such as EPS using a diluted share count. However, full ratchet anti-dilution provisions can be less favorable for companies.

That’s why many investors get attracted to the conversion feature of diluted securities and buy them. Public companies must report EPS on their income statement and include both primary and diluted EPS. When more than two potentially dilutive securities exist, anti-dilutive effects can be harder to detect. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The limitations of fully diluted EPS include assumptions and estimates in the calculation, inflation and currency fluctuations, non-recurring events and exceptional items, and industry-specific factors.

Dilutive securities include options, warrants, convertible debt, and anything else that can be converted into shares. Full ratchet anti-dilution works by providing investors with the highest level of protection against dilution. When a company issues new shares at a price lower than what previous investors paid, the full ratchet provision resets the conversion price of the investor’s convertible securities to this new, lower price. This means that the investor can convert their preferred shares or convertible debt into common shares at the same price as the new investors. Convertible equity is often called convertible preferred stock and usually converts to common stock on a preferential ratio. For example, each convertible preferred stock may convert to 10 shares of common stock, thus also diluting ownership of existing shareholders.

The Treasury stock method is used to calculate diluted EPS for potentially dilutive options or warrants. The options or warrants are considered dilutive if their exercise price is below the average market price of the stock for the year. After-tax interest on the convertible debt is added to the net income in the numerator and the new common shares that would be issued at the conversion are added to the denominator. In securities, when a company’s value or earnings per share (EPS) is reduced, that results in a dilutive effect. This can happen during a merger or acquisition when the number of common shares is increased and the target company’s profitability is lower than that of the acquiring company. The extent of the reduction in EPS is directly proportional to the percentage increase in the number of shares.

Ei̇dman Və Kazino Mərcləri >> Depozit Bonusu $1000 – 317

Ei̇dman Və Kazino Mərcləri >> Depozit Bonusu $1000 – 317