Selling each additional copy of a software product costs little since the distribution is almost free, and no “raw materials” are required (just support costs, infrastructure/bandwidth, etc.). Yes, but ensure you’re comparing companies within the same industry or sector, as operating leverage can vary significantly between different types of businesses. Operating Leverage is controlled by purchasing or outsourcing some of the company’s processes or services instead of keeping it integral to the company.

Telecom Company Example

The higher the degree of operating leverage, the greater the potential danger from forecasting risk, in which a relatively small error in forecasting sales can be magnified into large errors in cash flow projections. Each industry or sector will have operating margins respective to their particular sector. For example, the operating margins of Costco don’t compare to Visa as they are completely different types of business. Operating margins tell investors how efficiently the company creates profits from the business operations.

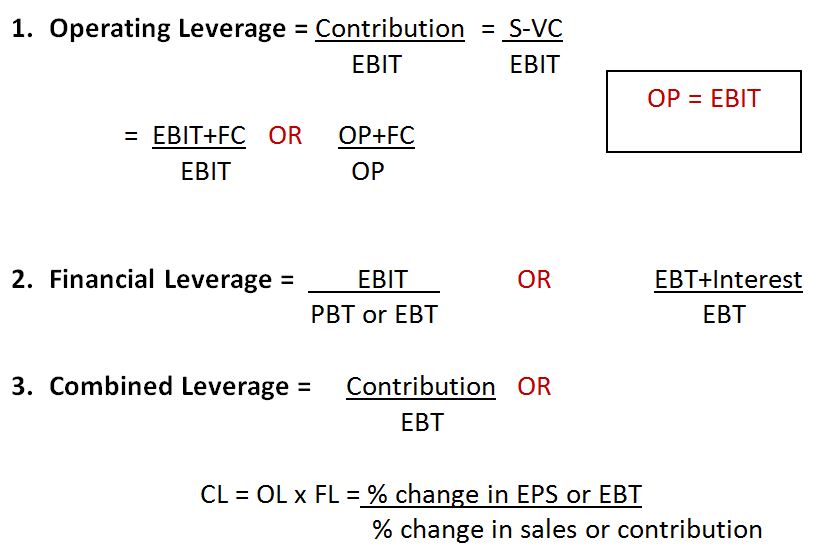

Company

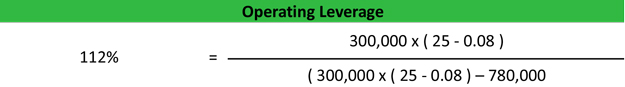

The degree of operating leverage can show you the impact of operating leverage on the firm’s earnings before interest and taxes (EBIT). Also, the DOL is important if you want to assess the effect of fixed costs and variable costs of the core operations of your business. John’s Software is a leading software business, which mostly incurs fixed costs for upfront development and marketing. John’s fixed costs are $780,000, which goes towards developers’ salaries and the fill fate definition supply chain cost per unit is $0.08. Given that the software industry is involved in the development, marketing and sales, it includes a range of applications, from network systems and operating management tools to customized software for enterprises. Operating leverage is a financial efficiency ratio used to measure what percentage of total costs are made up of fixed costs and variable costs in an effort to calculate how well a company uses its fixed costs to generate profits.

Would you prefer to work with a financial professional remotely or in-person?

Otherwise, add the specific period data in the section “Period to period specific data” above. We put this example on purpose because it shows us the worst and most confusing scenario for the operating leverage ratio. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. The only difference now is that the number of units sold is 5mm higher in the upside case and 5mm lower in the downside case.

Our Services

- High operating leverage during a downturn can be an Achilles heel, putting pressure on profit margins and making a contraction in earnings unavoidable.

- Despite the significant drop-off in the number of units sold (10mm to 5mm) and the coinciding decrease in revenue, the company likely had few levers to pull to limit the damage to its margins.

- Instead, the decisive factor of whether a company should pursue a high or low degree of operating leverage (DOL) structure comes down to the risk tolerance of the investor or operator.

- One notable commonality among high DOL industries is that to get the business started, a large upfront payment (or initial investment) is required.

- One of the most important factors that affect a company’s business risk is operating leverage; it occurs when a company must incur fixed costs during the production of its goods and services.

In this best-case scenario of a company with a high DOL, earning outsized profits on each incremental sale becomes plausible, but this type of outcome is never guaranteed. Suppose the operating income (EBIT) of a company grew from 10k to 15k (50% increase) and revenue grew from 20k to 25k (25% increase). The best way to illustrate the formula is to use a company’s financials to examine operating leverage. We will use Microsoft and their latest annual report dated July 30, 2020, as our guinea pig. Companies only create value when their operating profit exceeds their cost of capital; if those levels match or fall below, it is either destroying or not adding value. So, while operating leverage is a good starting point for an analysis, it gives you an incomplete picture unless you also consider overall margins and industry dynamics when comparing companies.

As a hypothetical example, say Company X has $500,000 in sales in year one and $600,000 in sales in year two. In year one, the company’s operating expenses were $150,000, while in year two, the operating expenses were $175,000. If you have the percentual change (period to period) of sales, put it here.

The degree of operating leverage corresponds with a company’s cost structure, and that cost structure is critical to the company’s profitability. Variable costs such as commissions flex as revenues rise, and commission expenses rise in tandem. The commissions of a company limit the degree of operating leverage they can bring to bear to improve profitability.

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Microsoft or Apple is a perfect example of a high-leverage operating business. My Accounting Course is a world-class educational resource developed by experts to simplify accounting, finance, & investment analysis topics, so students and professionals can learn and propel their careers.

The challenge that this type of business structure presents is that it also means that there will be serious declines in earnings if sales fall off. This does not only impact current Cash Flow, but it may also affect future Cash Flow as well. Fixed costs do not vary with the volume of sales, whereas variable costs vary directly with sales volume. Next, if the case toggle is set to “Upside”, we can see that revenue is growing 10% each year and from Year 1 to Year 5, and the company’s operating margin expands from 40.0% to 55.8%.

Few investors really know whether a company can expand sales volume past a certain level without, say, sub-contracting to third parties or making further capital investment, which would increase fixed costs and alter operational leverage. At the same time, a company’s prices, product mix and cost of inventory and raw materials are all subject to change. Without a good understanding of the company’s inner workings, it is difficult to get a truly accurate measure of the DOL. The Degree of Operating Leverage (DOL) is a financial metric that measures how a company’s operating income (EBIT) responds to changes in sales volume. It’s like a financial magnifying glass, showing how your fixed and variable costs can amplify changes in sales into larger changes in operating income.

Ei̇dman Və Kazino Mərcləri >> Depozit Bonusu $1000 – 317

Ei̇dman Və Kazino Mərcləri >> Depozit Bonusu $1000 – 317