It looks very much like the NPV equation except that the discount rate is the IRR instead of r, the required rate of return. The main difference between NPV and profitability index is that the PI is represented as a ratio, so it won’t indicate the cash flow size. A profitability index number might be 1.5, but you wouldn’t necessarily know the capital expenditure required. At the start of year 1 (today) there is a cash out flow of 4,000 representing an investment in a project. For simplicity, with no further investment, the amount of 6,000 is returned in 3 years time at the end of year 3. In summary, while the Profitability Index provides valuable insights, decision-makers must recognize its limitations.

- For example, Garch Ltd could invest in Catcher even though the initial investment required is $600,000 while the company only has $550,000 available to invest.

- The profitability index is often used to rank a firm’s investments and/or projects alongside others.

- Other measures include the payback period, discounted payback period, average accounting rate of return (AAR), and the profitability index (PI).

- In general terms, the higher the PI metric, the more attractive a proposed investment is.

- The internal rate of return (IRR) is the discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero.

- Examining and ranking multiple ventures, however, require you to treat the results with caution.

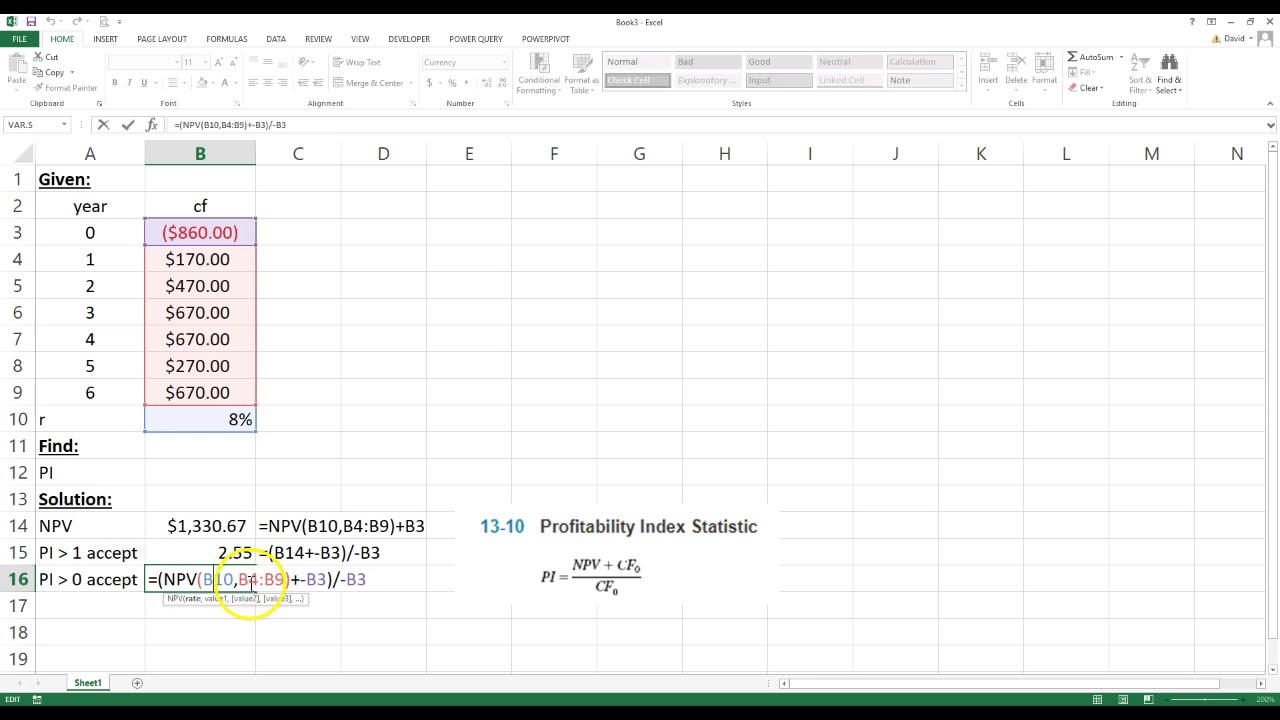

How to Calculate Profitability Index

Remember that while the PI has several advantages, it’s essential to consider its limitations too. For instance, it assumes constant cash flows and a fixed discount rate, which may not hold in all scenarios. Nevertheless, when used judiciously, the Profitability Index provides valuable insights for investment decisions.

Download the Project Profitability Template

By contrast, there are also a few limitations or disadvantages to the profitability index formula. The NPV shows you how profitable the project in question will be compared to alternative projects. Because the PI value is greater than one, the project will be profitable. With the profitability index, the higher the value, the more profitable the investment. In this comprehensive exploration of the Profitability Index (PI), we’ve delved into the intricacies of evaluating investment opportunities.

( . Project 1 and project 2 are both independent projects:

By comparing the PIs of each project, the firm can prioritize those with higher indices, ensuring that capital is allocated to the most profitable ventures. A ratio of 1 indicates that the present value of the underlying investment just equals its initial cash out outlay and is considered the lowest acceptable number for a proposal. A less than 1 PI ratio means that tax considerations for college students the project’s present value would not recover its initial investment or cost. Theoretically, it reveals unprofitability of a proposed investment and suggests rejection of the same. In general terms, the higher the PI metric, the more attractive a proposed investment is. The factory expansion project has a higher profitability index and a more attractive investment.

Statistics and Analysis Calculators

He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. In addition, as the PI increases, the profitability of the project increases, so the project should be ranked higher.

Key Takeaways

Examining and ranking multiple ventures, however, require you to treat the results with caution. That’s because the PI result simply ignores the projects’ scale and the absolute added shareholder value. Consider a project that costs $10 and has a $20 present value (Investment 1), and another one (Investment 2) that costs $1,000 with a $1,500 present value.

Certainly, the time a project requires to become profitable is a persistent concern for investors, and market factors can elongate the time table in unpredictable ways. The new factory project is expected to cost $2 million and generate cash flows of $300,000 per year for the next 5 years, also with a discount rate of 10%. If the IRR is lower than the cost of capital, the project should be killed.

In summary, the Profitability Index provides a concise way to evaluate investment opportunities, considering both financial efficiency and value creation. Remember that while PI is a valuable tool, it’s essential to complement it with other financial metrics and qualitative analysis to make informed decisions. A positive NPV indicates that the investment will generate value, while a negative NPV suggests the investment may not meet the required rate of return on investment.

Note that PI results are based on estimates rather than precise numbers taken from a firm’s major financial statements. Discounted cash flows may unexpectedly differ in the future, which immediately makes us question the predictive accuracy of both PI and NPV figures as stand-alone metrics. To build solid decision-making criteria for investments, we often combine it with other ratios.